An Unbiased View of Health Insurance In Dallas Tx

Table of ContentsUnknown Facts About Life Insurance In Dallas TxCommercial Insurance In Dallas Tx - An OverviewExamine This Report about Home Insurance In Dallas TxSome Known Details About Truck Insurance In Dallas Tx Insurance Agency In Dallas Tx Things To Know Before You BuyLife Insurance In Dallas Tx for Beginners

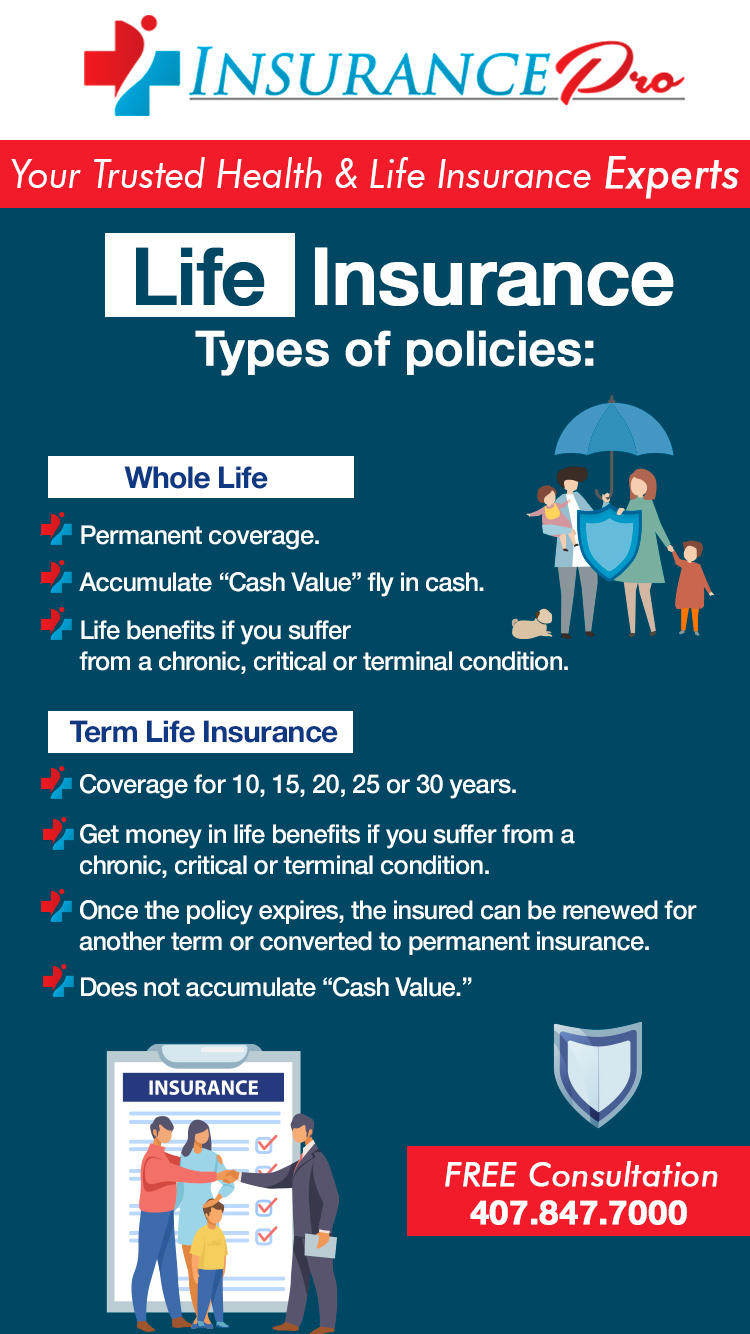

And also since this insurance coverage lasts for your entire life, it can assist support lasting dependents such as kids with disabilities. Disadvantage: Price & complexity a whole life insurance policy policy can be significantly much more costly than a term life plan for the very same fatality advantage amount. The money value part makes whole life more intricate than term life due to fees, taxes, interest, as well as other terms.

Cyclists: They're optional attachments you can use to customize your plan. Some policies feature motorcyclists immediately consisted of, while others can be added at an extra price. Term life insurance policy policies are normally the very best remedy for people that need cost effective life insurance for a particular period in their life.

Excitement About Truck Insurance In Dallas Tx

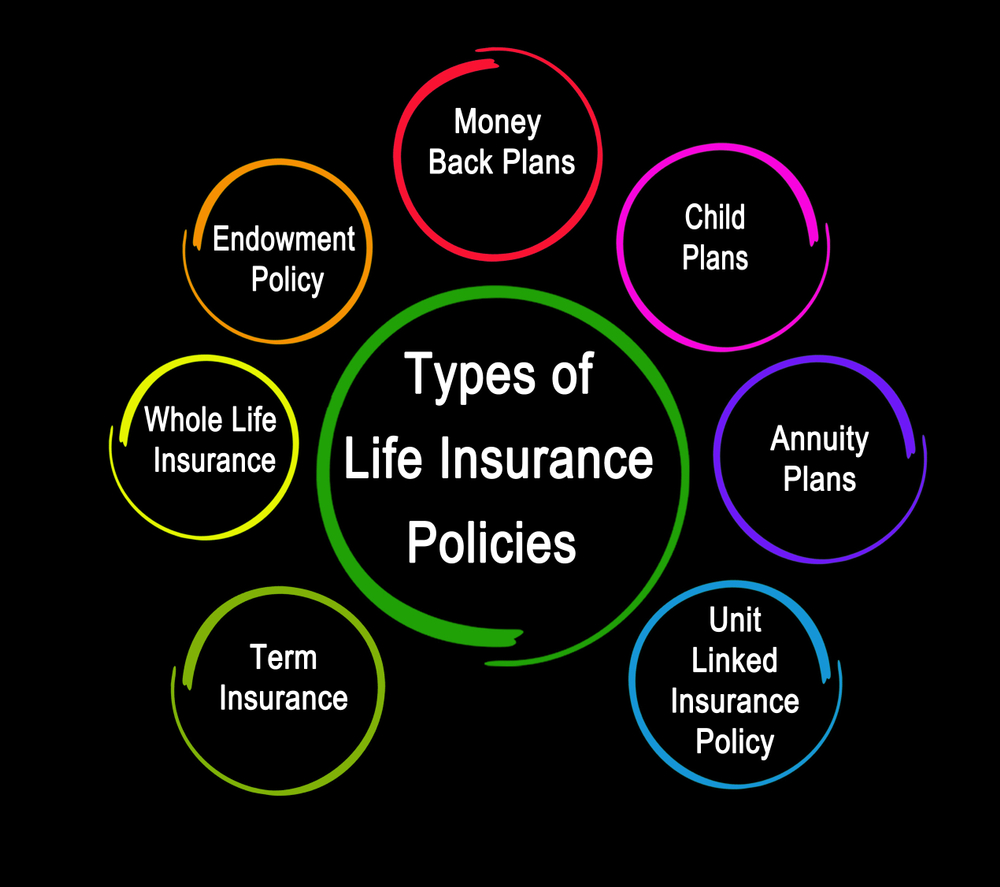

" It's constantly advised you talk to a certified representative to determine the best remedy for you." Collapse table Since you're acquainted with the essentials, below are added life insurance policy plan kinds. Several of these life insurance policy alternatives are subtypes of those included above, meant to serve a specific purpose.

Pro: Time-saving no-medical-exam life insurance supplies faster access to life insurance policy without needing to take the medical exam (Insurance agency in Dallas TX). Con: Individuals that are of old age or have numerous health conditions might not be eligible. Best for: Any person who has few wellness difficulties Supplemental life insurance policy, likewise called volunteer or volunteer additional life insurance, can be utilized to bridge the insurance coverage space left by an employer-paid group policy.

Unlike other plan kinds, MPI just pays the survivor benefit to your home loan loan provider, making it a far more minimal alternative than a conventional life insurance coverage plan. With an MPI plan, the recipient is the home loan firm or lending institution, as opposed to your family members, and the death advantage reduces in time as you make home mortgage payments, comparable to a lowering term life insurance policy plan.

The 9-Minute Rule for Life Insurance In Dallas Tx

Because AD&D only pays under details scenarios, it's not an appropriate Continued replacement for life insurance policy. AD&D insurance policy just pays if you're hurt or you can find out more killed in an accident, whereas life insurance policy pays out for a lot of reasons of death. Due to the fact that of this, AD&D isn't ideal for everybody, yet it may be valuable if you have a high-risk line of work.

The Best Guide To Commercial Insurance In Dallas Tx

Best for: Couples that don't get approved for 2 private life insurance policy policies, There are 2 major kinds of joint life insurance policy policies: First-to-die: The policy pays after the first of the 2 partners dies. First-to-die is the most similar to a private life insurance policy policy. It helps the surviving policyholder cover expenses after the loss of financial backing.

They'll be able to assist you compare life insurance coverage companies quickly as well as conveniently, and also find the best life insurance coverage firm for your conditions. What are the two main kinds of life insurance policy? Term as well as irreversible are both main kinds of life insurance coverage. The main difference between both is that term life insurance policies have an expiry date, offering coverage in between 10 and also 40 years, as well as irreversible plans never run out.

Both its duration and also cash money value make long-term life insurance coverage several times a lot more expensive than term. Term life insurance is usually the most find out here now inexpensive and also detailed type of life insurance due to the fact that it's straightforward as well as supplies economic defense throughout your income-earning years.

Getting My Life Insurance In Dallas Tx To Work

Entire, universal, indexed global, variable, as well as burial insurance are all kinds of long-term life insurance policy. Irreversible life insurance policy usually comes with a cash money value and also has greater premiums. What is the most usual kind of life insurance policy? Term life and also entire life are the most popular sorts of life insurance policy.

life insurance coverage market in 2022, according to LIMRA, the life insurance policy research organization. Term life costs represented 19% of the market share in the exact same duration (bearing in mind that term life costs are much less expensive than entire life costs).

There are four standard parts to an insurance coverage agreement: Affirmation Web page, Insuring Contract, Exemptions, Conditions, It is very important to recognize that multi-peril plans might have specific exemptions and conditions for every kind of coverage, such as collision coverage, clinical repayment protection, obligation protection, and more. You will certainly need to make sure that you read the language for the specific protection that puts on your loss.

Some Ideas on Commercial Insurance In Dallas Tx You Should Know

g. $25,000, $50,000, etc). This is a recap of the major promises of the insurance coverage firm as well as states what is covered. In the Insuring Contract, the insurance provider concurs to do specific things such as paying losses for protected dangers, offering particular solutions, or concurring to safeguard the insured in an obligation legal action.

Examples of left out residential or commercial property under a house owners plan are personal home such as a vehicle, a pet dog, or an airplane. Conditions are stipulations placed in the policy that certify or put constraints on the insurance company's assurance to pay or do. If the plan conditions are not fulfilled, the insurer can refute the insurance claim.